How One Small Change Can Help Your Business Recover 9% in Profits

There is a growing problem today for small to medium sized businesses like yours that you may not be fully aware of. You are working with a cash flow model that is literally leaving money on the table. Your business is not cash flow optimized for getting you paid on-time, on your terms and without hidden fees.

What if within minutes you could make one small change to your business which could add nine percent to your bottom line profit this year?

This is a problem that we solved for ourselves which led us to reimagining what the future of payments could be for small businesses.

The good news is that hundreds of accounting firms, digital agencies, IT professional services firms and other small businesses have been able to recover an average of five to ten percent of their profits simply by switching to BizPayO, the world’s first Cash Flow Optimization Platform.

First let’s dig into the problems that most of our customers experience before using the BizPayO platform. Do any of these sound familiar?

You don’t want to lose 3-4% of your sales by accepting credit card payments, so you’re ok getting paid by check.

Many small businesses either accept the absorbent credit card processing fees or are forced to take the risk of slow customer payments by accepting paper checks just to avoid these fees.

Sure you can shop around for lower fee providers but at the end of the day those low fee providers will find another way to make up for this by adding transaction and interchange fees. Smart businesses today no longer have to accept this and in fact can now accept credit card and ACH payments at zero net cost.

Your clients “pay slow” or not at all.

Simply sending an invoice and hoping that your clients pay on-time makes cash flow forecasting unpredictable and risky. And it’s disrespectful towards your good work. Even providing an online payment method gets underutilized because your engagement agreement or customer proposal doesn’t automatically link to a payment method.

Every month you need to “chase down” clients for payment or spend yet more money having your admin or bookkeeper collect payment. Not to mention the friction caused in your customer relationship. When they do pay you need to match the payment to the invoice then finally manually key it all into your accounting program and confirm that it actually posts to your bank account.

In this age of slow food and slow travel, slow payments do not make for a healthy business.

You have no single view of your payments from initial engagement to when the payment actually hits your bank account.

The following is the tedious and costly process that many professional services businesses and consultants are still using today:

- Send customer engagement or proposal

- Secure proper signature of acceptance

- Receive payment for engagement

- Add customer to your database

- Create engagement invoice

- Apply deposit against engagement invoice

- Make bank deposit

- Increase cash & income on books

- Set up future invoicing intervals

- Create future invoices

- Time spent for collections

- Receive payment for invoices

- Apply deposit against invoices

- Make bank deposit

- Increase cash & income on books

Fifteen manual steps that either you are doing yourself or hoping that your bookkeeper is staying on top of every month–and for every customer! An unnecessary amount of labor costs and time. Cash flow optimization is the process of automating these key tasks while saving you time and money in no longer having to deal with these drains on your time and resources.

Your existing payment processor misses the forest for the trees

Anyone can throw a “Pay Now” button on their website and hope that not only it is clicked, but the payment is actually made promptly. To us hope is not a strategy. This is why we have completely reimagined not just getting paid timely, but what we call Cash Flow Optimization. In other words thinking through every step of your existing process and getting you to that nine percent additional bottom line profit that most of our customers experience.

What Is Cash Flow Optimization?

Cash flow optimization is going from little to no control over your cash flow process to a fully optimized cash flow experience.

Let’s look at a real cash flow optimization example so you can see where BizPayO will fit into your business:

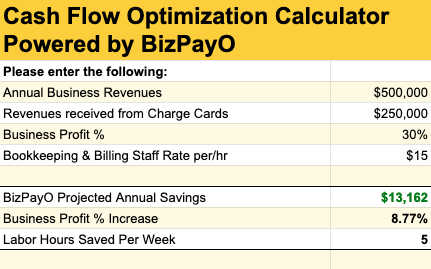

Let’s say that you’re an IT Managed Services Provider with $500,000 in annual business revenue. A half of your revenues are paid via credit cards ($250,000). Your business profit is approximately 30% and you pay a bookkeeper or billing clerk $15 per hour to manage your accounts receivable.

Based this scenario you could potentially realize the following savings with the BizPayO Cash Flow Optimization platform:

BizPayo Projected Annual Savings: $13,162

Business Profit % Increase: 8.77%

Labor Hours Saved Per Week: 5

Here’s that in a table:

How did we calculate this? Great question! These are the variables that we use in our calculator:

- Total business profit

- Savings from our UpCharge Technology

- Labor cost savings from BizPayO accounting system sync integration

- Labor cost savings from rebilling and collection efforts

- Time Value of money calculation for Opportunity Cost

- Assuming a BizPayO Fully-Optimized subscription plan ($49/mo.)

To plug in your businesses’ numbers and calculate your own savings you can download our free BizPayO Cash Flow Optimization Calculator here.

How BizPayO Recovers Your Revenue

Recovering revenue is just one of the many benefits of transforming your business with cash flow optimization. Our value is helping businesses get from a basic “Level 1” business to an optimized “Level 3” business as follows:

Level 1: No Cash Flow Optimization

Has an accounting system in place but no online one-time or recurring payments capability, no ability to recover fees, no customer engagements linked to payments and no automatic transactions synchronization to accounting software. No roles-based user access security.

Level 2: Basic Cash Flow Optimization

Has an accounting system in place, accepts basic electronic payments, no fee recovery, no customer engagement linked to payments, no automatic transactions synced to accounting software. Roles-based user access security.

Level 3: Cash Flow Optimized

Has an accounting system in place, has electronic one-time and recurring payments capability, ability to recover fees, customer engagements linked to payments, and automatic transactions synced to accounting software. Roles-based user access security.

How To Put Your Cash Flow on Autopilot

BizPayO is not simply an online payments platform but the first Cash Flow Optimization Platform (CFOP) that puts your entire cash flow on autopilot. Our platform allows you to optimize your cash flow process end-to-end including sending engagement letters/proposals, accepting online payment, managing recurring transactions, forecasting your cash flow in the dashboard and automatically syncing it all to QuickBooks.

BizPayO is a web-based platform, built and trusted by accountants and other professionals that requires no contract, no upfront implementation costs (sets up in minutes) and can be cancelled at anytime. If you are wasting time and money on any of the steps above BizPayO is for you.

Sign up in minutes and get cash flow optimized. We promise to help you go from client accepted to cash flow collected faster, cheaper and easier than you have ever experienced before.